Auto Insurance Coverage And Windshield Replacement

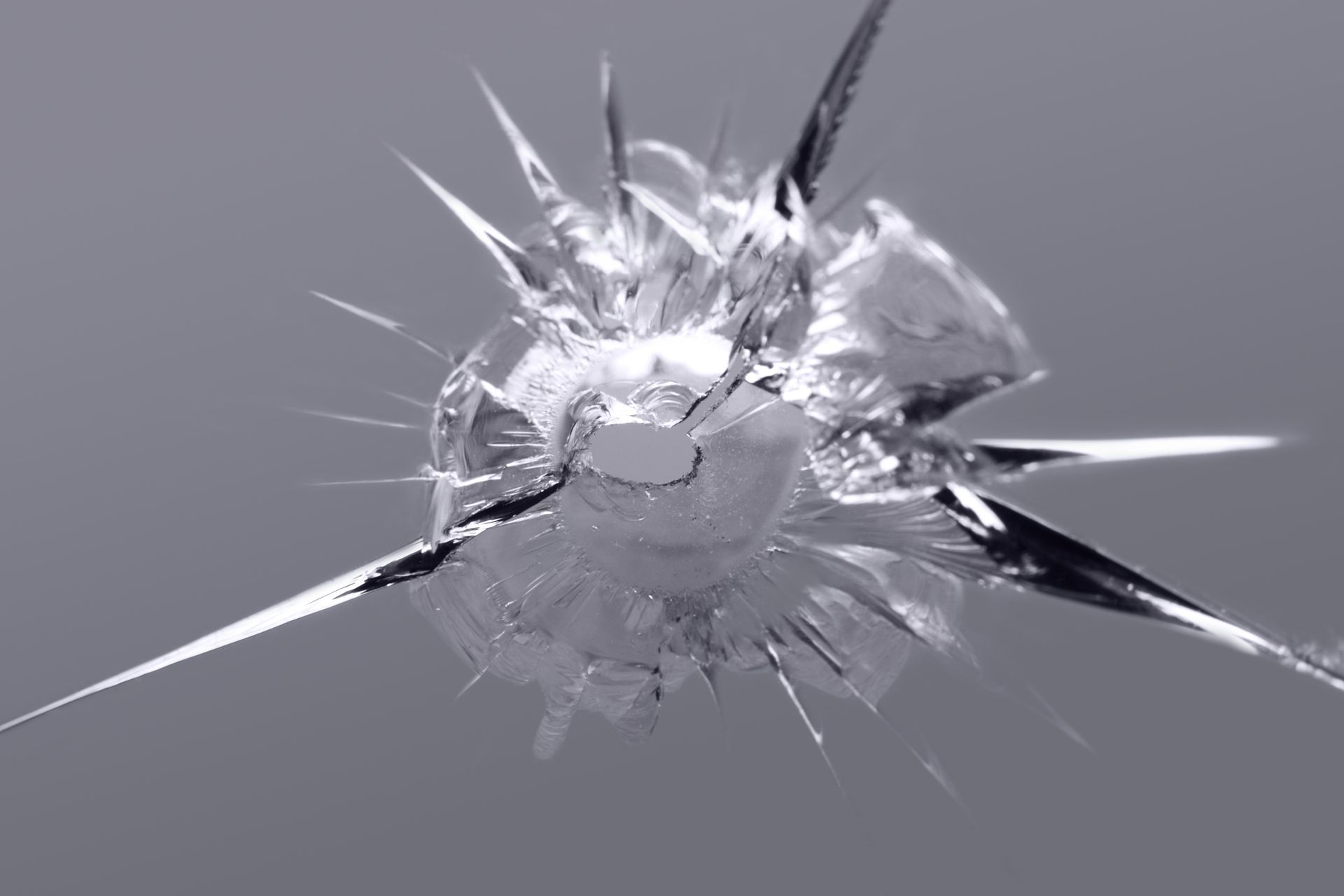

When it comes to maintaining your vehicles, unexpected damage like a cracked or shattered windshield can be a real headache. You're not alone if you're wondering if you can use your auto insurance to help you with your new windshield's costs: as many as 30% of auto insurance claims are related to windshields. It's essential to understand how auto insurance can help cover the costs of windshield replacement or repair. Sometimes, it's best to pay out of pocket, while other times, it's best to use your auto insurance to help pay for your services. Delve into the details of using your auto insurance to get a new windshield on your car and discuss situations where paying out of pocket may be a better option. You can also learn whether getting a windshield replacement affects your policy and how auto insurance works with windshield replacement companies.

How Auto Coverage Works for Windshield Replacement

Auto insurance coverage for windshield replacement varies depending on your policy and the circumstances surrounding the damage, including if there is other damage to your vehicle in addition to the windshield damage. In general, comprehensive coverage usually includes coverage for glass damage, which would cover windshield replacement or repair so long as the cause of the comprehensive damage falls under your auto insurance's allowances. However, it's important to check with your insurance provider to verify if your specific policy covers glass damage and what deductible applies.

When Auto Insurance Does Not Cover

There are instances when auto insurance does not cover windshield replacement, such as minor cracks or chips that do not impair visibility or are not considered dangerous so long as they get repaired timely. In these cases, it may be more cost-effective to pay out of pocket for repairs rather than filing an insurance claim, which could potentially increase your premiums in the long run. You can get a quote for rock chip repair and other windshield damages from your auto glass repair specialist. Additionally, some policies may have specific exclusions for glass damage caused by certain events like vandalism or acts of nature. It's important to speak to your auto insurance agent about your situation to see if you can use auto insurance to assist you with your windshield replacement or repair costs.

Is Paying Out Of Pocket Better?

Paying out of pocket for windshield replacement can sometimes be a better option than using auto insurance if the cost of the repair is lower than your deductible. For example, if your deductible is $500 and the cost of replacing your windshield is $300, it may be more economical to pay for the repair yourself rather than filing an insurance claim. Keep in mind that multiple claims within a short period can lead to increased premiums, so consider this when deciding whether to use your auto insurance, especially if you have made multiple claims over time.

Getting a windshield replacement should not typically affect your policy unless you have multiple claims within a short timeframe. However, it's always a good idea to check with your insurance provider before proceeding with any repairs to ensure there are no unexpected consequences. If you do need to file an insurance claim for glass damage, make sure you have all the necessary documentation and information ready to provide to your insurer.

Does Auto Insurance Work With Auto Glass Specialists?

When it comes time to replace your windshield, many auto insurance companies work directly with preferred glass repair shops or companies that offer discounts for policyholders. For this reason, your auto insurance agent may have recommendations for specific auto glass areas in your company, although you can typically choose any auto glass specialist you want. Letting your auto glass specialist handle the details of your windshield repair or replacement needs can streamline the process and make it easier for you to get back on the road quickly without having to navigate the claims process on your own. Be sure to ask your insurer about any partnerships they have with glass repair companies and take advantage of any benefits they may offer.

Understanding how auto insurance can help cover the costs of windshield replacement is essential for every vehicle owner. This can be especially important if your windshield replacement costs are higher because of the type of windshield you need or other damages your vehicle has. By knowing what is covered under your policy, when paying out of pocket makes more sense, and how getting a windshield replacement affects your policy, you can make informed decisions when faced with unexpected damages. Remember to check with your insurer about coverage options and partnerships with glass repair companies to ensure a smooth process when dealing with glass damage issues in the future. For all your auto glass needs, call MS Glass Outlet today. We'll walk you through the process of repairing or replacing your auto glass.